Business

Revolutionising Entertainment: Meet the AI-Powered Startup Disrupting the Trillion-Dollar IP Sector

Pixelynx and KOR Protocol are transforming the entertainment IP sector with AI and blockchain technology, offering creators new ways to monetise their work.

Published

9 months agoon

By

AIinAsia

TL;DR:

- Pixelynx and KOR Protocol are disrupting the entertainment IP sector with AI and blockchain technology.

- Over $50M in funding has been secured from major investors like Animoca Brands and Solana.

- Black Mirror experience generated over $250,000 in sales in just 2 hours.

In the ever-evolving world of entertainment, one startup is making waves by leveraging the power of AI and blockchain technology. Pixelynx and its flagship product, KOR Protocol, are transforming how creators monetise their intellectual property (IP). This innovative platform is not just a game-changer; it’s a revolution in the trillion-dollar entertainment IP sector.

The Birth of Pixelynx and KOR Protocol

Back in 2020, CEO and co-founder Inder Phull met with Grammy-nominated artists deadmau5 and Richie Hawtin. These meetings were pivotal in accelerating Pixelynx and KOR Protocol to what it is today. Inder’s journey into blockchain began in 2014 when the concept was first introduced at the International Music Summit. Despite initial scepticism, Inder’s vision to address key challenges in the music industry through blockchain technology attracted attention from global organisations like Microsoft and Beatport.

From Music to Entertainment IP

What started as an interactive music platform allowing users to co-create music with artists through AI tools quickly evolved into a suite of products powered by the KOR Protocol. The company now boasts over 100 international partners, including Beatport, Japanese telecom giant KDDI, and Banijay (producers of Black Mirror and Peaky Blinders). These partnerships have resulted in interactive experiences and mints that appeal to global fan communities.

One notable success story is the Black Mirror experience in partnership with Banijay and Base. This collection sold out immediately, generating over $250,000 in sales in just two hours. KOR Protocol is designed to enable IPs to bring their assets on-chain, powering new use cases such as authenticated on-chain AI model training.

Early Years in Crypto

Inder’s fascination with cryptocurrencies began when he discovered a project by songwriter and producer Imogen Heap. Years later, he met Ben Turner, the founder of the International Music Summit and a long-time manager of Richie Hawtin, who introduced Inder to Dean Wilson and deadmau5.

KOR Protocol seeks to develop viable ways for creators to monetise their IPs through blockchain technology. For instance, songs from deadmau5’s record label mau5trap have been remixed over 100,000 times through user-generated content and distributed on streaming platforms to earn royalties and rewards.

The Newest IP Brainchild

The self-service platform allows users to create IP-based experiences powered by the KOR Protocol. Users can browse content from over 500 IPs, build AI-based music experiences through its KORUS, or interact with partner IPs like The Black Mirror Experience to create unique stories and NFTs.

The company aims to serve IP holders and independent artists who lack the infrastructure, resources, and networks to gain visibility and monetise their work. KOR Protocol offers a decentralised solution where independent artists can directly manage and monetise their IP, reach global audiences, collaborate with new partners, and engage with fans in different ways.

Empowering Creators

With features like automated royalty distribution, on-chain rights management, and community governance, independent artists can ensure fair compensation and have a direct say in the protocol’s development. Additionally, the open-source culture of KOR Protocol connects artists with technologists, fostering collaboration and innovation through these new mediums. This empowers them to compete on a more equal footing with established artists, fostering innovation and creativity across the board.

Safeguarding Artist IPs

KOR Protocol uses various smart-contract technologies to safeguard artist IPs, providing a secure, on-chain repository where creators can manage their assets. The platform is working towards the KOR DNA metadata standard, which will ensure that all content is accurately documented and protected with key licensing and usage data embedded into the assets through decentralised content identifiers. Additionally, KOR Protocol integrates user verification processes and partnerships with leading security firms to maintain the integrity of the network.

Growth Strategies

KOR Protocol aims to scale globally by continuing to expand through various IP partnerships with iconic creators and brands, through community building, and by developing a robust infrastructure. As far as monetisation for artists is concerned, KOR Protocol addresses digital rights management (DRM) and compensation for artists in a decentralised environment through several mechanisms. By leveraging blockchain technology, the protocol ensures transparent and immutable recording of all IP rights and licensing information, making it easy to track and verify usage. Automated royalty distribution via smart contracts guarantees that artists are paid fairly and promptly whenever their work is used or sold.

A Post-Hype Platform

KOR Protocol sees the blockchain-based IP management system moving beyond its current speculative phase into providing more practical utility long term. The early success through initiatives in partnerships with Black Mirror and deadmau5 demonstrates the tangible value that the product can create. Despite the volatile shifts in the Web3 landscape, Inder remains bullish. “In the ’90s, web developers were the pioneers of a digital frontier. Today, blockchain-based applications are the new frontier, and soon, it will be the standard. If you’re not on board, you’re not just behind—you’re missing the future of innovation and creativity.”

Comment and Share:

What do you think about the future of AI and blockchain in the entertainment industry? Share your thoughts and experiences below, and don’t forget to subscribe for updates on AI and AGI developments.

You may also like:

- To learn more about one of the key investors in KOR Protocol, Animoca Brands tap here.

Author

Discover more from AIinASIA

Subscribe to get the latest posts sent to your email.

You may like

-

If AI Kills the Open Web, What’s Next?

-

Unearthly Tech? AI’s Bizarre Chip Design Leaves Experts Flummoxed

-

How Did Meta’s AI Achieve 80% Mind-Reading Accuracy?

-

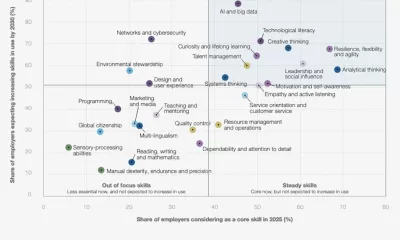

How to Prepare for AI’s Impact on Your Job by 2030

-

We (Sort Of) Missed the Mark with Digital Transformation

-

Reality Check: The Surprising Relationship Between AI and Human Perception

Business

Adrian’s Arena: Stop Collecting AI Tools and Start Building a Stack

How to transform scattered AI tools into a strategic stack that drives real business outcomes. Practical advice for startups and enterprises.

Published

1 week agoon

May 23, 2025

TL;DR — What You Need To Know

- Stop collecting random AI tools and start building an intentional “stack” – a connected system of tools that work together to solve your specific business problems.

- The best AI stacks aren’t complicated but intentional – they reduce friction, create clarity, and become second nature to your team’s workflow.

- For Southeast Asian businesses, successful AI stacks must address regional complexities like language diversity, mobile-first users, and local regulations.

Why Your AI Approach Needs a Rethink

Look around and you’ll see AI tools popping up everywhere – they’re like coffee shops in Singapore, one on every corner promising to give your business that perfect boost.

But here’s what I keep noticing in boardrooms and startup meetings: everyone’s got tools, but hardly anyone has a proper stack.

Most teams aren’t struggling to find AI tools. They’re drowning in disconnected tabs – ChatGPT open here, Perplexity bookmarked there, Canva floating around somewhere, and that Zapier automation you set up months ago but barely remember how to use.

They’ve got all the ingredients but no kitchen. No real system for turning all this potential into actual business results.

AI stack vs. tool collection

It’s so easy to jump on the latest shiny AI thing, isn’t it? The hard part is connecting these tools into something that actually moves your business forward.

When I talk to leaders about building real AI capability, I don’t start by asking what features they want. I ask what problems they’re trying to solve. What’s slowing their team down? Where are people burning valuable time on tasks that don’t deserve it?

That’s where stack thinking comes in. It’s not about collecting tools – it’s about designing a thoughtful, functional system that reflects how your business actually operates.

The best AI stacks I’ve seen aren’t complicated – they’re intentional. They remove friction. They create clarity. And most importantly, they become second nature to your team.

Building Intentional AI Workflows

For smaller teams and startups, an effective AI stack can be surprisingly simple. I often show founders how just four tools – something like ChatGPT, Perplexity, Ideogram, and Canva – can take you from initial concept to finished marketing asset in a single afternoon. It’s lean, fast, and totally doable for under $100 a month. For small businesses, this kind of setup becomes a secret weapon that levels the playing field without expanding headcount.

But once you’re in mid-sized or enterprise territory, things get more layered. You’re not just looking for speed – you’re managing complexity, accountability, and scale. Tools need to talk to each other, yes, but they also need to fit into approval workflows, compliance requirements, and multi-market realities.

That’s where most random collections of tools start to break down.

When Your AI Stack Actually Works

You know your AI stack is working when it feels like flow, not friction.

Your marketing team moves from insight to idea to finished asset in hours instead of weeks. Your sales team walks into meetings already knowing the context that matters. Your HR people personalise onboarding without rebuilding slides for every new hire.

This isn’t theoretical – I’ve watched it happen in real organisations across Southeast Asia, where tools aren’t just available, they’re aligned. When AI stacks are built thoughtfully around actual business needs, they deliver more than efficiency – they bring clarity, confidence, and control.

And again, this is exactly what we focus on at SQREEM. Our ONE platform isn’t designed to replace your stack – it’s built to expand its capabilities, delivering the intelligence layer that boosts performance, cuts waste, and turns behavioural signals into strategic advantage.

Because the best stacks don’t just work harder. They help your people think better and move faster.

The Southeast Asia Factor

If you’re building a business in Southeast Asia, the game is a little different.

Your AI stack needs to handle the region’s complexity – language diversity, mobile-first users, and regulatory differences. That means choosing tools that are multilingual, work well on phones, and respect local privacy laws like PDPA. There’s no point automating customer outreach if it gets flagged in Vietnam or launching a chatbot that can’t understand Bahasa Indonesia.

The smartest stacks I’ve seen in SEA are light, fast, and culturally aware. They don’t try to do everything. They focus on what matters locally – and they deliver results.

Why This Matters Right Now

If AI is the new electricity, then stacks are the wiring. They determine what gets powered, what stays dark, and what actually transforms your business.

Too many teams are stuck in the “tool hoarding” phase – downloading, demoing, trying things out. But that’s not transformation. That’s just tinkering.

The real shift happens when teams design their workflows with AI at the centre. When they align their stack with their business strategy – and build in engines like SQREEM that drive real-world precision from day one.

That’s when AI stops being a novelty and starts being your competitive edge.

It’s the same shift we see in startups that go from idea to execution in a weekend. It’s the same shift large companies make when they finally move from small pilots to company-wide impact.

And it’s available to any team willing to think system-first.

A Simple Test

Here’s a quick way to check where you stand: If every AI tool you use disappeared overnight… what part of your workflow would actually break?

If the answer is “nothing much,” you don’t have a stack. You have some clever toys.

But if the answer is “everything would grind to a halt” – good. That means you’re not just playing with AI. You’ve made it essential to how you operate.

And here’s the harder question: Is your AI stack simply helping you move faster – or is it actually helping you compete smarter?

If you’re serious about building the kind of AI stack that drives real outcomes – not just activity – I’d love to hear how you’re approaching it. What’s in your stack today? Where are you seeing gaps? Drop a comment below and let’s swap ideas.

Thanks for reading!

Adrian 🙂

Author

-

Adrian is an AI, marketing, and technology strategist based in Asia, with over 25 years of experience in the region. Originally from the UK, he has worked with some of the world’s largest tech companies and successfully built and sold several tech businesses. Currently, Adrian leads commercial strategy and negotiations at one of ASEAN’s largest AI companies. Driven by a passion to empower startups and small businesses, he dedicates his spare time to helping them boost performance and efficiency by embracing AI tools. His expertise spans growth and strategy, sales and marketing, go-to-market strategy, AI integration, startup mentoring, and investments. View all posts

Discover more from AIinASIA

Subscribe to get the latest posts sent to your email.

Business

Apple’s China AI pivot puts Washington on edge

Apple’s partnership with Alibaba to deliver AI services in China has sparked concern among U.S. lawmakers and security experts, highlighting growing tensions in global technology markets.

Published

2 weeks agoon

May 21, 2025By

AIinAsia

As Apple courts Alibaba for its iPhone AI partnership in China, U.S. lawmakers see more than just a tech deal taking shape.

TL;DR — What You Need To Know

- Apple has reportedly selected Alibaba’s Qwen AI model to power its iPhone features in China

- U.S. lawmakers and security officials are alarmed over data access and strategic implications

- The deal has not been officially confirmed by Apple, but Alibaba’s chairman has acknowledged it

- China remains a critical market for Apple amid declining iPhone sales

- The partnership highlights the growing difficulty of operating across rival tech spheres

Apple Intelligence meets the Great Firewall

Apple’s strategic pivot to partner with Chinese tech giant Alibaba for delivering AI services in China has triggered intense scrutiny in Washington. The collaboration, necessitated by China’s blocking of OpenAI services, raises profound questions about data security, technological sovereignty, and the intensifying tech rivalry between the United States and China. As Apple navigates declining iPhone sales in the crucial Chinese market, this partnership underscores the increasing difficulty for multinational tech companies to operate seamlessly across divergent technological and regulatory environments.

Apple Intelligence Meets Chinese Regulations

When Apple unveiled its ambitious “Apple Intelligence” system in June, it marked the company’s most significant push into AI-enhanced services. For Western markets, Apple seamlessly integrated OpenAI’s ChatGPT as a cornerstone partner for English-language capabilities. However, this implementation strategy hit an immediate roadblock in China, where OpenAI’s services remain effectively banned under the country’s stringent digital regulations.

Faced with this market-specific challenge, Apple initiated discussions with several Chinese AI leaders to identify a compliant local partner capable of delivering comparable functionality to Chinese consumers. The shortlist reportedly included major players in China’s burgeoning AI sector:

- Baidu, known for its Ernie Bot AI system

- DeepSeek, an emerging player in foundation models

- Tencent, the social media and gaming powerhouse

- Alibaba, whose open-source Qwen model has gained significant attention

While Apple has maintained its characteristic silence regarding partnership details, recent developments strongly suggest that Alibaba’s Qwen model has emerged as the chosen solution. The arrangement was seemingly confirmed when Alibaba’s chairman made an unplanned reference to the collaboration during a public appearance.

“Apple’s decision to implement a separate AI system for the Chinese market reflects the growing reality of technological bifurcation between East and West. What we’re witnessing is the practical manifestation of competing digital sovereignty models.”

Washington’s Mounting Concerns

The revelation of Apple’s China-specific AI strategy has elicited swift and pronounced reactions from U.S. policymakers. Members of the House Select Committee on China have raised alarms about the potential implications, with some reports indicating that White House officials have directly engaged with Apple executives on the matter.

Representative Raja Krishnamoorthi of the House Intelligence Committee didn’t mince words, describing the development as “extremely disturbing.” His reaction encapsulates broader concerns about American technological advantages potentially benefiting Chinese competitors through such partnerships.

Greg Allen, Director of the Wadhwani A.I. Centre at CSIS, framed the situation in competitive terms:

“The United States is in an AI race with China, and we just don’t want American companies helping Chinese companies run faster.”

The concerns expressed by Washington officials and security experts include:

- Data Sovereignty Issues: Questions about where and how user data from AI interactions would be stored, processed, and potentially accessed

- Model Training Advantages: Concerns that the vast user interactions from Apple devices could help improve Alibaba’s foundational AI models

- National Security Implications: Worries about whether sensitive information could inadvertently flow through Chinese servers

- Regulatory Compliance: Questions about how Apple will navigate China’s content restrictions and censorship requirements

In response to these growing concerns, U.S. agencies are reportedly discussing whether to place Alibaba and other Chinese AI companies on a restricted entity list. Such a designation would formally limit collaboration between American and Chinese AI firms, potentially derailing arrangements like Apple’s reported partnership.

Commercial Necessities vs. Strategic Considerations

Apple’s motivation for pursuing a China-specific AI solution is straightforward from a business perspective. China remains one of the company’s largest and most important markets, despite recent challenges. Earlier this spring, iPhone sales in China declined by 24% year over year, highlighting the company’s vulnerability in this critical market.

Without a viable AI strategy for Chinese users, Apple risks further erosion of its market position at precisely the moment when AI features are becoming central to consumer technology choices. Chinese competitors like Huawei have already launched their own AI-enhanced smartphones, increasing pressure on Apple to respond.

“Apple faces an almost impossible balancing act. They can’t afford to offer Chinese consumers a second-class experience by omitting AI features, but implementing them through a Chinese partner creates significant political exposure in the U.S.

The situation is further complicated by China’s own regulatory environment, which requires foreign technology companies to comply with data localisation rules and content restrictions. These requirements effectively necessitate some form of local partnership for AI services.

A Blueprint for the Decoupled Future?

Whether Apple’s partnership with Alibaba proceeds as reported or undergoes modifications in response to political pressure, the episode provides a revealing glimpse into the fragmenting global technology landscape.

As digital ecosystems increasingly align with geopolitical boundaries, multinational technology firms face increasingly complex strategic decisions:

- Regionalised Technology Stacks: Companies may need to develop and maintain separate technological implementations for different markets

- Partnership Dilemmas: Collaborations beneficial in one market may create political liabilities in others

- Regulatory Navigation: Operating across divergent regulatory environments requires sophisticated compliance strategies

- Resource Allocation: Developing market-specific solutions increases costs and complexity

What we’re seeing with Apple and Alibaba may become the norm rather than the exception. The era of frictionless global technology markets is giving way to one where regional boundaries increasingly define technological ecosystems.

Looking Forward

For now, Apple Intelligence has no confirmed launch date for the Chinese market. However, with new iPhone models traditionally released in autumn, Apple faces mounting time pressure to finalise its AI strategy.

The company’s eventual approach could signal broader trends in how global technology firms navigate an increasingly bifurcated digital landscape. Will companies maintain unified global platforms with minimal adaptations, or will we see the emergence of fundamentally different technological experiences across major markets?

As this situation evolves, it highlights a critical reality for the technology sector: in an era of intensifying great power competition, even seemingly routine business decisions can quickly acquire strategic significance.

You May Also Like:

- Alibaba’s AI Ambitions: Fueling Cloud Growth and Expanding in Asia

- Apple Unleashes AI Revolution with Apple Intelligence: A Game Changer in Asia’s Tech Landscape

- Apple and Meta Explore AI Partnership

Author

Discover more from AIinASIA

Subscribe to get the latest posts sent to your email.

Business

AI Just Killed 8 Jobs… But Created 15 New Ones Paying £100k+

AI is eliminating roles — but creating new ones that pay £100k+. Here are 15 fast-growing jobs in AI and how to prepare for them in Asia.

Published

3 weeks agoon

May 13, 2025By

AIinAsia

TL;DR — What You Need to Know:

- AI is replacing roles in moderation, customer service, writing, and warehousing—but it’s not all doom.

- In its place, AI created jobs paying £100k: prompt engineers, AI ethicists, machine learning leads, and more.

- The winners? Those who pivot now and get skilled, while others wait it out.

Let’s not sugar-coat it: AI has already taken your job.

Or if it hasn’t yet, it’s circling. Patiently. Quietly.

But here’s the twist: AI isn’t just wiping out roles — it’s creating some of the most lucrative career paths we’ve ever seen. The catch? You’ll need to move faster than the machines do.

The headlines love a doomsday spin — robots stealing jobs, mass layoffs, the end of work. But if you read past the fear, you’ll spot a very different story: one where new six-figure jobs are exploding in demand.

And they’re not just for coders or people with PhDs in quantum linguistics. Many of these jobs value soft skills, writing, ethics, even common sense — just with a new AI twist.

So here’s your clear-eyed guide:

- 8 jobs that AI is quietly (or not-so-quietly) killing

- 15 roles growing faster than a ChatGPT thread on Reddit — and paying very, very well.

8 Jobs AI Is Already Eliminating (or Shrinking Fast)

1. Social Media Content Moderators

Remember the armies of humans reviewing TikTok, Instagram, and Facebook posts for nudity or hate speech? Well, they’re disappearing. TikTok now uses AI to catch 80% of violations before humans ever see them. It’s faster, tireless, and cheaper.

Most social platforms are following suit. The remaining humans deal with edge cases or trauma-heavy content no one wants to automate… but the bulk of the work is now machine-led.

2. Customer Service Representatives

You’ve chatted with a bot recently. So has everyone.

Klarna’s AI assistant replaced 700 human agents in one swoop. IKEA has quietly shifted call centre support to fully automated systems. These AI tools handle everything from order tracking to password resets.

The result? Companies save money. Customers get 24/7 responses. And entry-level service jobs vanish.

3. Telemarketers and Call Centre Agents

Outbound sales? It’s been digitised. AI voice systems now make thousands of simultaneous calls, shift tone mid-sentence, and even spot emotional cues. They never need a lunch break — and they’re hard to distinguish from a real person.

Companies now use humans to plan campaigns, but the actual calls? Fully automated. If your job was cold-calling, it’s time to reskill — fast.

4. Data Entry Clerks

Manual input is gone. OCR + AI means documents are scanned, sorted, and uploaded instantly. IBM has paused hiring for 7,800 back-office jobs as automation takes over.

Across insurance, banking, healthcare — companies that once hired data entry clerks by the dozen now need just a few to manage exceptions.

5. Retail Cashiers

Self-checkout kiosks were just the start. Amazon Go stores use computer vision to eliminate the checkout experience altogether — just grab and go.

Walmart and Tesco are rolling out similar models. Even mid-sized retailers are using AI to reduce cashier shifts by 10–25%. Humans now restock and assist — not scan.

6. Warehouse & Fulfilment Staff

Amazon’s warehouses are a case study in automation. Autonomous robots pick, pack, and ship faster than any human.

The result? Fewer injuries, more efficiency… and fewer humans.

Even smaller logistics firms are adopting warehouse AI, as costs drop and robots become “as-a-service”.

7. Translators & Content Writers (Basic-Level)

Generative AI is fast, multilingual, and on-brand. Duolingo replaced much of its content writing team with GPT-driven systems.

Marketing teams now use AI for product descriptions, blogs, and ads. Humans still do strategy — but the daily word count? AI’s job now.

8. Entry-Level Graphic Designers

AI tools like Midjourney, Ideogram, and Adobe Firefly generate visuals from a sentence. Logos, pitch decks, ad banners — all created in seconds. The entry-level designer who used to churn out social graphics? No longer essential.

Top-tier creatives still thrive. But production design? That’s already AI’s turf.

Are you futureproofed—or just hoping you’re not next?

15 AI-Driven Jobs Now Paying £100k+

Now for the exciting bit. While AI clears out repetitive roles, it also opens new high-paying jobs that didn’t exist 3 years ago.

These aren’t sci-fi ideas. These are real jobs being filled today — many in Singapore, Australia, India, and Korea — with salaries to match.

1. Machine Learning Engineer

The architects of AI itself. They build the algorithms powering everything from fraud detection to self-driving cars.

Salary: £85k–£210k

Needed: Python, TensorFlow/PyTorch, strong maths. Highly sought after across finance, healthcare, and Big Tech.

2. Data Scientist

Translates oceans of data into actual insights. Think Netflix recommendations, pricing strategies, or disease forecasting.

Salary: £70k–£160k

Key skills: Python, SQL, R, storytelling. A killer combo of tech + communication.

3. Prompt Engineer

No code needed — just words.

They craft the perfect prompts to steer AI models like ChatGPT toward accurate, helpful results.

Salary: £110k–£200k+

Writers, marketers, and linguists are all pivoting into this role. It’s exploding.

4. AI Product Manager

You don’t build the AI — you make it useful.

This role bridges business needs and tech teams to launch products that solve real problems.

Salary: £120k–£170k

Ideal for ex-consultants, startup leads, or technical PMs with an eye for product-market fit.

5. AI Ethics / Governance Specialist

Someone has to keep the machines honest. These specialists ensure AI is fair, safe, and compliant.

Salary: £100k–£170k

Perfect for lawyers, philosophers, or policy pros who understand AI’s social impact.

6. AI Compliance / Audit Specialist

GDPR. HIPAA. The EU AI Act.

These specialists check that AI systems follow legal rules and ethical standards.

Salary: £90k–£150k

Especially hot in finance, healthcare, and enterprise tech.

7. Data Engineer / MLOps Engineer

Behind every smart model is a ton of infrastructure.

Data Engineers build it. MLOps Engineers keep it running.

Salary: £90k–£140k

You’ll need DevOps, cloud computing, and Python chops.

8. AI Solutions Architect

The big-picture thinker. Designs AI systems that actually work at scale.

Salary: £110k–£160k

In demand in cloud, consulting, and enterprise IT.

9. Computer Vision Engineer

They teach machines to see.

From autonomous cars to medical scans to supermarket cameras — it’s all vision.

Salary: £120k+

Strong Python + OpenCV/TensorFlow is a must.

10. Robotics Engineer (AI + Machines)

Think factory bots, surgical arms, or drone fleets.

You’ll need both hardware knowledge and machine learning skills.

Salary: £100k–£150k+

A rare mix = big pay.

11. Autonomous Vehicle Engineer

Still one of AI’s toughest challenges — and best-paid verticals.

Salary: £120k+

Roles in perception, planning, and safety. Tesla, Waymo, and China’s Didi all hiring like mad.

12. AI Cybersecurity Specialist

Protect AI… with AI.

This job prevents attacks on models and builds AI-powered threat detection.

Salary: £120k+

Perfect for seasoned security pros looking to specialise.

13. Human–AI Interaction Designer (UX for AI)

Humans don’t trust what they don’t understand.

These designers make AI usable, friendly, and ethical.

Salary: £100k–£135k

Great path for UXers who want to go deep into AI systems.

14. LLM Trainer / Model Fine-tuner

You teach ChatGPT how to behave. Literally.

Using reinforcement learning, you align models with human values.

Salary: £100k–£180k

Ideal for teachers, researchers, or anyone great at structured thinking.

15. AI Consultant / Solutions Specialist

Advises companies on where and how to use AI.

Part analyst, part strategist, part translator.

Salary: £120k+

Management consultants and ex-founders thrive here.

The Bottom Line: You Don’t Need to Fear AI. You Need to Work With It.

If AI is your competition, you’re already behind. But if it’s your co-pilot, you’re ahead of 90% of the workforce.

This isn’t just about learning to code. It’s about learning to think differently.

To communicate with machines.

To spot where humans still matter — and amplify that with tech.

Because while AI might be killing off 8 jobs…

It’s creating 15 new ones that pay double — and need smart, curious, adaptable people.

So—

Will you let AI automate you… or will you get paid to run it?

You may also like:

AI Upskilling: Can Automation Boost Your Salary?

How Will AI Skills Impact Your Career and Salary in 2025?

Will AI Kill Your Marketing Job by 2030?

Author

Discover more from AIinASIA

Subscribe to get the latest posts sent to your email.

Upgrade Your ChatGPT Game With These 5 Prompts Tips

If AI Kills the Open Web, What’s Next?

Build Your Own Custom GPT in Under 30 Minutes – Step-by-Step Beginner’s Guide

Trending

-

Life3 weeks ago

Life3 weeks ago7 Mind-Blowing New ChatGPT Use Cases in 2025

-

Learning2 weeks ago

Learning2 weeks agoHow to Use the “Create an Action” Feature in Custom GPTs

-

Business3 weeks ago

Business3 weeks agoAI Just Killed 8 Jobs… But Created 15 New Ones Paying £100k+

-

Tools3 weeks ago

Tools3 weeks agoEdit AI Images on the Go with Gemini’s New Update

-

Learning1 week ago

Learning1 week agoBuild Your Own Custom GPT in Under 30 Minutes – Step-by-Step Beginner’s Guide

-

Learning2 weeks ago

Learning2 weeks agoHow to Upload Knowledge into Your Custom GPT

-

Business1 week ago

Business1 week agoAdrian’s Arena: Stop Collecting AI Tools and Start Building a Stack

-

Life3 weeks ago

Life3 weeks agoAdrian’s Arena: Will AI Get You Fired? 9 Mistakes That Could Cost You Everything